2023 Indiana Consulting Foresters Stumpage Timber Price Report

This report is provided annually and is intended to be used as a general indicator of timber stumpage prices and activity in Indiana. There are many factors that determine the price of any individual timber sale, including tree species and quality, average tree volume, size of sale, ease of operability, access and yarding issues, proximity to markets, region of the State, availability of other timber in the area, number of bidders interested in the sale, season it can be logged, economic forecasts and many more. For this reason, the reported prices should not be considered as a guarantee of the value for any given sale. However, this report can be used as a general trend of timber sale prices and where the range would be for most sales meeting the same criteria. To best market your timber, it is recommended you contact a consultant forester that can gauge your timber value in your area and markets.

To create the report a survey was made of all known professional consulting foresters in Indiana. Sales were reported from all areas of the State. Prices were reported from sealed bid timber sales (not negotiated sales) between a motivated seller and a licensed Indiana timber buyer. The data represents sales from January 1 to December 31, 2023. This survey has been conducted annually since 2001.

Timber Sale Price Survey

Timber sale categories: As in the past, sales were reported in three categories based on quality. A high-quality sale has more than 50 percent of the volume in #2 or better red oak, white oak, sugar maple, black cherry, black walnut or soft maple. A low-quality sale has more than 70 percent of the volume in #3 grade (low or pallet grade) or is cottonwood, beech, elm, sycamore, hackberry, pin oak, aspen, black gum, black locust, honeylocust, catalpa, sweetgum or pine. An average sale is a sale that is neither a high- or low-quality sale.

Survey responses: There were 17 consultants that reported prices this year. This is an increase from the 15 that reported last year and in the range of the 15 to 20 that have reported each year since 2015. Prices were reported from 201 sales which is an increase from the 172 sales from last year but a decrease from the 270 sales reported in 2021. The annual average since 2014 is 272 sales reported. Reported sale volumes increased from 14,261,907 board feet in 2022 to 16,549,728 board feet in 2023, however, that is still less than the 25,049,006 board feet in 2021. The average reported sale volumes have averaged 23,905,579 board feet since 2015. Total sale values, over all three categories, also increased from last years $12,057,263 to $13,873,573 this year.

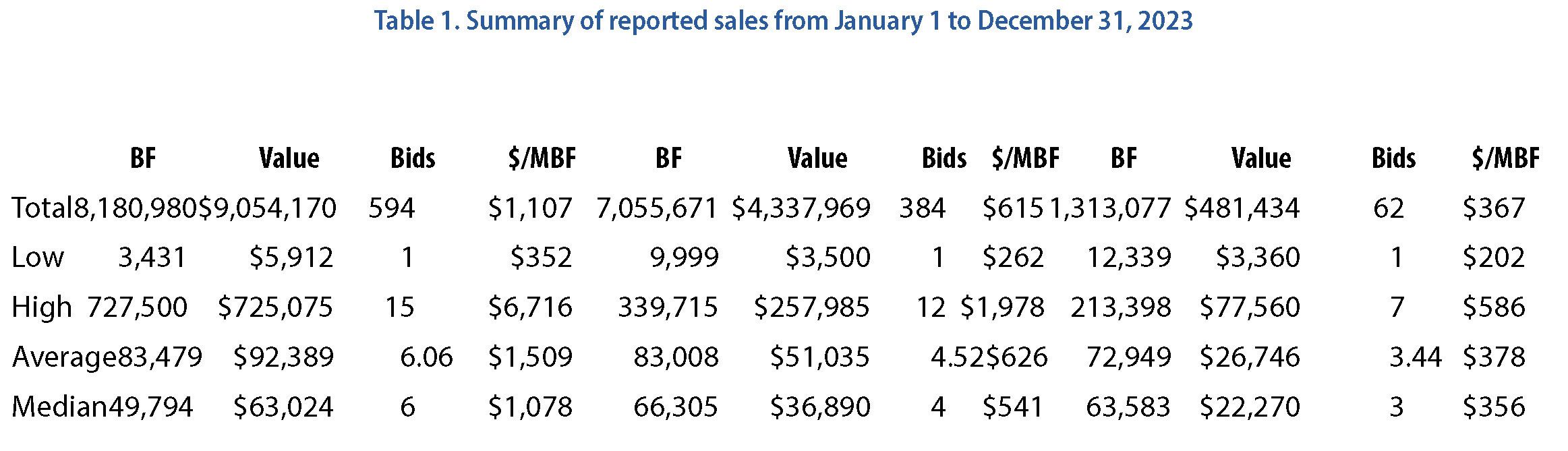

High quality sales: There were a total of 98 sales reported by 13 respondents in this category. Sale volumes ranged from a low of 3,431 board feet to a high of 727,500 board feet. The average high-quality sale was 83,479 board feet. The median volume was 49,794 board feet. The weighted average of these sales was $1,107/MBF (thousand board feet). This price is up about 2% from last year’s $1,086/MBF and about 5% below the historical high of $1,164 in 2021. Due to high demand for walnut and white oak, and the wide range in their values, this category typically has a wide range of sale prices. The quantity and quality of these species in a given sale will determine the value of that sale. Therefore, the range within this group went from a low of $352 to a high of $6,716/MBF.

Medium quality sales: Sixteen consultants reported 85 sales in this category. Sale volumes ranged from 9,999 board feet to 339,715 board feet and averaged 83,008 board feet per sale. The median sale volume was 66,305 board feet. These sales averaged $615/MBF, a nearly 6% decline from last year’s historical high $654. The range of prices by sale went from a low of $262 to a high of $1,978/MBF.

Medium quality sales: Sixteen consultants reported 85 sales in this category. Sale volumes ranged from 9,999 board feet to 339,715 board feet and averaged 83,008 board feet per sale. The median sale volume was 66,305 board feet. These sales averaged $615/MBF, a nearly 6% decline from last year’s historical high $654. The range of prices by sale went from a low of $262 to a high of $1,978/MBF.

Low quality sales: Only 7 consultants reported 18 low quality sales. Sale volumes ranged from a low of 12,339 board feet to a high of 213,398 board feet. The average sale was 72,949 board feet and the median volume was 63,583 board feet. The sale prices ranged from a low of $202/MBF to a high of $586/MBF and averaged $367/MBF. This is a nearly 13% decline from the $420/MBF in 2022, which was also a historical high for the category.

Survey Response Discussion

Volume of timber sold: Since the survey only catches a voluntary sampling of the timber sales occurring across the state, the number of reported sales cannot be definitively used to indicate an increase or decrease in the total number of sales or volume of timber being sold. In 2023 the numbers of sales, total harvest volumes and total sale values were all slightly increased over 2022 but still less than the historical averages. Consultants are still indicating, as they did last year, that they are having fewer sales due to a combination of increased workload in other areas of their businesses, mainly invasive control and TSI; and prices dropping after the unprecedented price spike of 2021 and early 2022. The general feeling seems to be that landowners and foresters are being more selective in the sales they are offering, particularly sales with low quality timber.

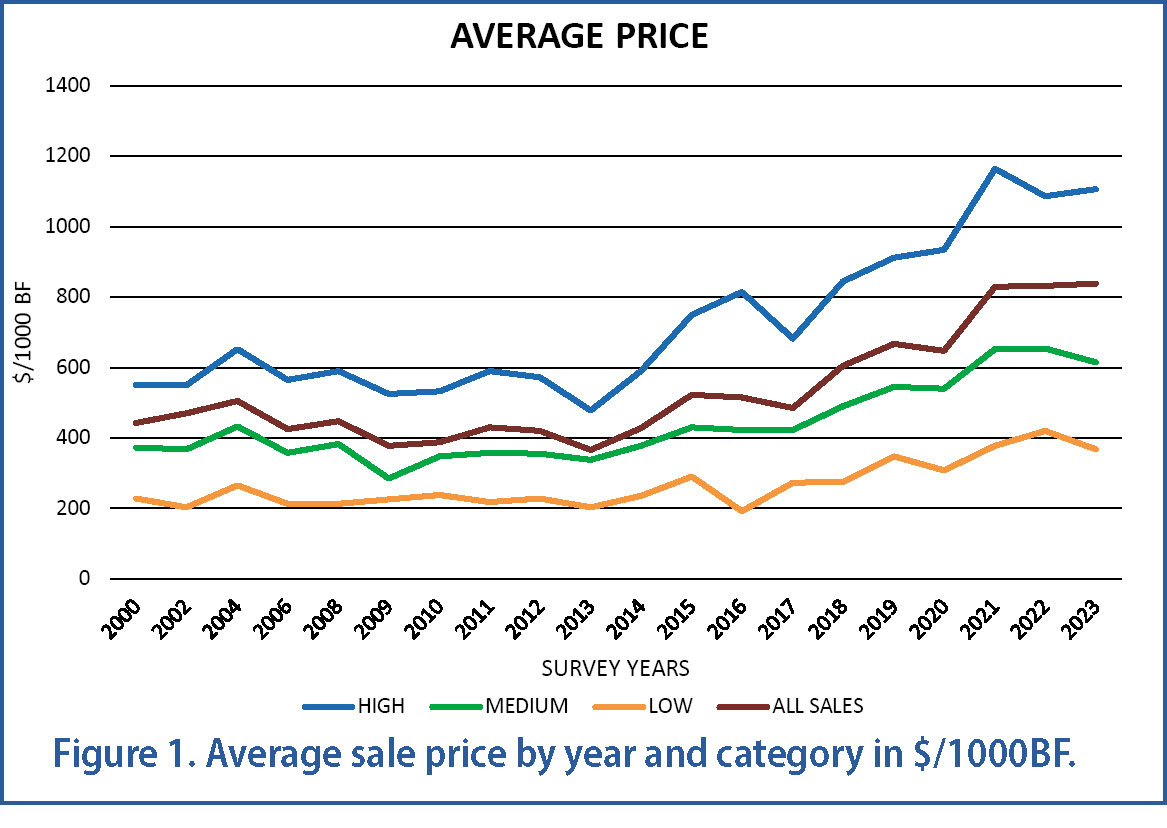

Value of timber sold: In 2022, there was a sharp difference in the prices for the first half of the year in comparison to the second six months. The survey showed that for all three categories, prices actually increased in the first six months of 2022 from the record highs of 2021. Prices then took a significant decline in the second half of 2022 with the averages for the year being near, or in the case of the medium and low-quality sales, setting new highs over the prices for 2021. For 2023, prices appear to have rebounded from the second half declines of 2022 though falling short of the highs of 2021 and 2022. In 2023 high quality sales averaged $1,107/MBF, well above the 2022 second half average of $831/MBF and slightly above the $1,086 for the entire 2022. Medium quality sales in 2023 averaged $615/MBF, above the 2022 second half $581/MBF but short of the historic high of $654/MBF for the year. Low quality sales for 2023 averaged $367/MBF. This is above the $334/MBF in the second half of 2022 but well short of the $420/MBF for the all of 2022. It is important to note that even though all three categories are below the record highs, they are still well above any prices reported prior to 2021. See Figure 1 for the annual prices.

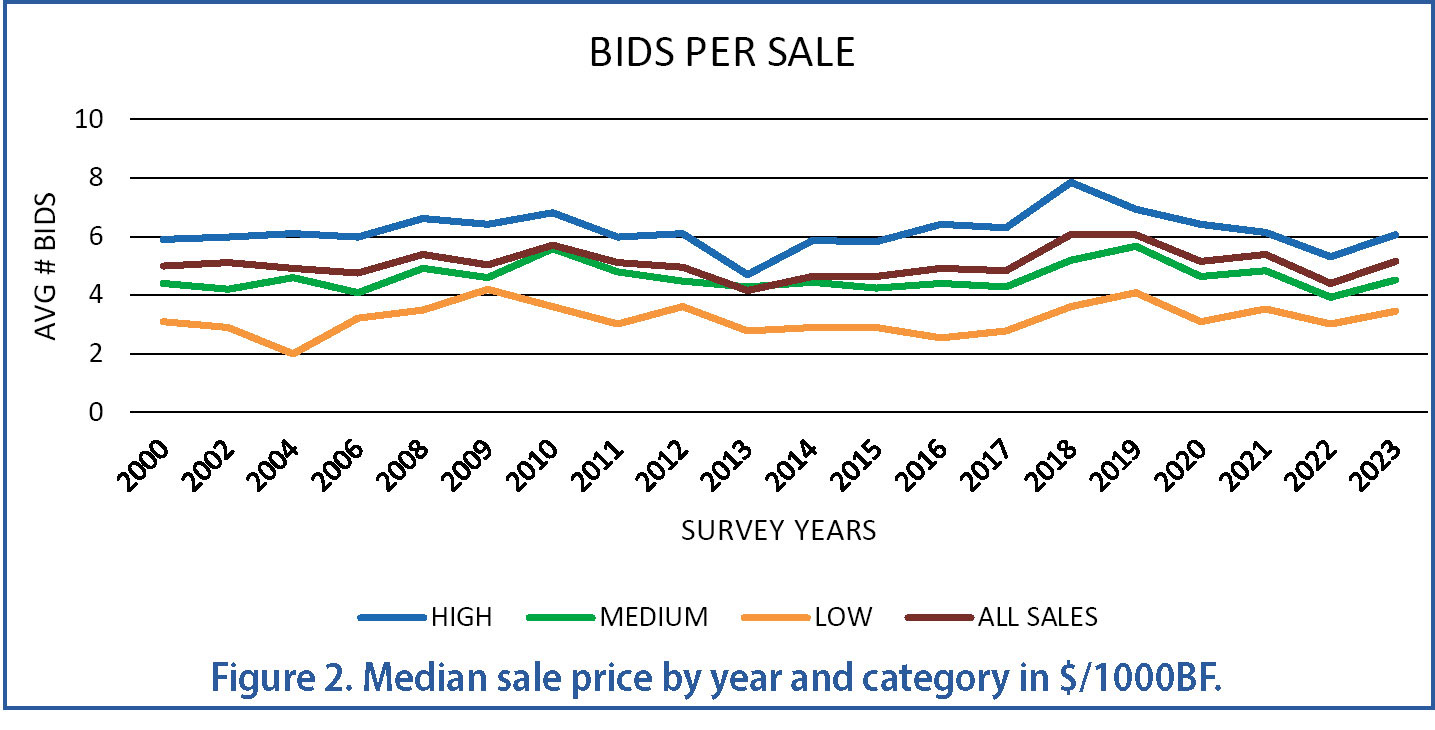

Median values: In contrast to averages, which can be skewed by extremely low or high values, median values are often a better indicator of timber value trends. The median values in 2023 tell a similar but slightly different story than the average prices do. For 2023 the median timber sale value for a high-quality stand was $1,078/MBF. This is very close to the average price of $1,107/MBF and an about 5% increase over the 2022 median value of $1,026/MBF. This indicates a similar trend as the average values of a strong demand for quality timber. The median value for medium-quality sales for 2023 was $541/MBF. This is significantly less than the $615/MBF in the average sale and a 12% decline from the $614/MBF median price in 2022. For low-quality sales, the 2023 median price is $356/MBF. This is close to the $367/MBF average price but as in the case of the medium-quality sales, also a steep decline from the 2022 median price of $469/MBF. The declines in the medium and low-quality sales (12% and 24% respectively) may indicate lower values for those quality of sales despite an increase in the numbers of bidders for those sales (see next section). However, these prices need to be kept in the perspective that the 2023 median prices for all quality categories are higher than any median prices reported before 2019. See Figure 2.

Median values: In contrast to averages, which can be skewed by extremely low or high values, median values are often a better indicator of timber value trends. The median values in 2023 tell a similar but slightly different story than the average prices do. For 2023 the median timber sale value for a high-quality stand was $1,078/MBF. This is very close to the average price of $1,107/MBF and an about 5% increase over the 2022 median value of $1,026/MBF. This indicates a similar trend as the average values of a strong demand for quality timber. The median value for medium-quality sales for 2023 was $541/MBF. This is significantly less than the $615/MBF in the average sale and a 12% decline from the $614/MBF median price in 2022. For low-quality sales, the 2023 median price is $356/MBF. This is close to the $367/MBF average price but as in the case of the medium-quality sales, also a steep decline from the 2022 median price of $469/MBF. The declines in the medium and low-quality sales (12% and 24% respectively) may indicate lower values for those quality of sales despite an increase in the numbers of bidders for those sales (see next section). However, these prices need to be kept in the perspective that the 2023 median prices for all quality categories are higher than any median prices reported before 2019. See Figure 2.

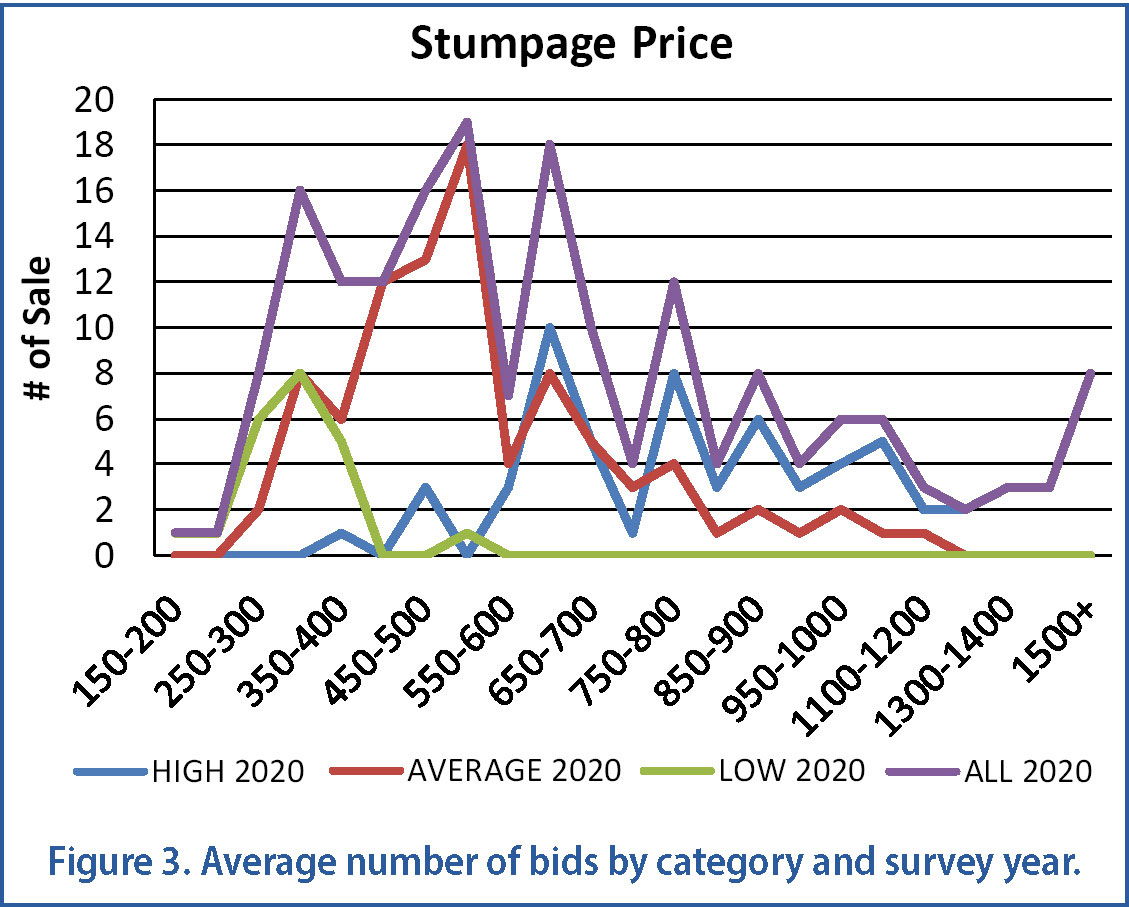

Sale bids: Across all of the sale categories there were a total of 1,040 bids received for the 201 timber sales. This is an average of 5.17 bids per sale. This is an increase from 2022’s 4.42 bids per sale and comparable to the historical average of 5.07 bids per sale. However, it is less than the average from 2018 to 2022 of 5.42 bids per sale. For high quality sales the average number of bidders was 6.06. This is an increase over the 2022 5.30 bids per sale and not far off the historical average of 6.18 bids per sale. Medium-quality sales in 2023 averaged 4.52 bids per sale. This is an increase from the 3.93 bids per sale in 2022 and close to the 4.59 bids per sale for the historical average, but well short of the high of 5.67 bids per sale in 2019. Low-quality sales in 2023 averaged 3.44 bids per sale. This is an increase from the 3.00 bids per sale in 2022 and over the 3.19 bids per sale historical average. However, the number of bidders for low-quality sales was as high as 3.55 bids per sale as recently as 2021. See Figure 3.

Conclusions: Despite an increase in the number of sales reported, consultants are still reporting conducting fewer sales than normal due to doing other types of forestry work. They also report they are being cautious with sales that don’t have walnut or white oak due to lower prices. However, according to the survey, prices in all three categories bounced back in 2023 from the drop in the second half of 2022. While prices have not returned to the highs of 2021 and the first half of 2022, historically they are still strong numbers. This is especially true for high quality sales where prices are only off the record price in 2021 by less than 5%. The average price for medium quality and low-quality sales were off about 6% and 12.5% respectively from the highs set in 2022. Despite the lower prices for medium and low-quality sales, the number of bidders for those sales increased. This may indicate steady markets for that type of material but at lower than historically high prices. Landowners and their consultants need to consider whether to sell low and medium quality sales during historically strong prices or wait for higher prices that may or may never return.

Consultant Comments and Other Thoughts

Consultant Comments and Other Thoughts

Note: These comments are the opinions of individuals from different parts of the State and with different markets. They may or may not be relevant to your situation. You should always discuss timber marking and marketing with your consultant to get the best information relating to your timber management.

Overall, prices held very steady throughout the year. Most of the sales brought a fair number of bidders but that is always determined by location, access, etc. One Amish logger bought 3 of the larger sales otherwise was pretty spread out amongst the common buyers in our area.

We keep being told these prices are not reflective of what is going on in the market…but they’ve been saying that all year.

I had EQIP contracts flowing out my ears that consumed most of my time, forcing me to turn down a few marking jobs for landowners that couldn’t wait.

Prices weren’t overly good, so I’ve decided to hold off on a few to hopefully get a better price later (for those landowners who don’t mind waiting a little while longer).

I ran into something this year, more so than in previous years. I found myself planning a harvest in amongst an EQIP contract that hasn’t been funded yet. For example: I’ve prepared at least three plans where I want to do at least 1 year of Brush Management (or two), have a timber sale, and then follow it up with Forest Stand Improvement. It creates some scheduling conflicts, but I believe it works well. That said, I have sales planned in the coming months/years, but am waiting on NRCS to determine how best to proceed.

The second half of the year saw more buyer interest on the stumpage/sale side in our area, however I believe prices did not change significantly over the course of the year, just number of bids.

We have a few buyers who consistently pay higher prices for sales including white oak and black walnut, regardless of the rest of the market. Other species, like maple seemed to struggle all year so we avoided selling much.

We have been struggling to keep up with the demand for Invasive control work and still keep up with calls for timber sales. We made a point to actively pursue timber sales this year, even if it meant putting off invasive control work, as we hardly sold any timber in 2022 (a good year). This led to more stress and a few unfinished projects that needed extensions or follow up work over the winter, but it was worthwhile.

This was historically a decently strong year in terms of sales and a high proportion of the sales were higher quality. We are continuing to get requests for appointments to sell timber for new clients, as well as old ones who are now 10-12 yrs out from the last sale. We are also continuing to get several bids on most of our sales and buyer interest is consistent, even with lower grade timber in most cases. We anticipate moderating interest rates to provide a boost to housing markets as fears of recession are starting to fade, that should bode well for stumpage prices to stay strong or maybe increase accordingly. 2024 should be better than 2023, generally.

Logging access is becoming difficult in the northern part of the state in the winter season. We still use crop fields for yarding in many cases, and that’s often an issue. The traditional 2-3 week of frozen ground we were used to does not happen anymore. Crews are forced to work in a 2-3 day window in semi-frozen, or drier conditions before the next thaw/rain. Winter cold is unsteady and unpredictable, snow falls on thawed ground and delaying access further. Landowners who were used to frozen logging conditions and smaller skidders in the past are needing to be educated about this and we are adjusting our expectations accordingly. We are seeing a trend of loggers using multiple traditional crews/personnel or mechanized logging equipment to cut jobs in a fraction of the time when weather permits. Trucking then follows as weather allows, with the logging crew on to the next job.

Mechanized logging is now in use by multiple crews in northern Indiana, and they cut in high volume, moving equipment as quickly as possible. Even smaller jobs are being cut with these machines, but the moving costs are high so the production rate must compensate. District Foresters and consultants often can’t make time to do logging inspections before the job is done, in a few days or less. Landowners are not used to mechanized logging, however most foresters are pleased with their work so far. I think many of us believe that it will become an issue when mechanized logging is used by lower skilled operators, but for now only the best/better crews are using it. Obvious differences include: faster production, wider trails, less rutting (generally), tops often crushed/cut into more pieces, tops often grouped in piles, tops and small trees crushed and used as “corduroy” for trails in wet areas to increase flotation/traction. The feller buncher operators are more capable with regards to leaning/hazard trees and clearing temporary yarding areas in woodlands. In some cases, the operators are using small understory trees for traction/bumpers that foresters would normally kill with TSI after harvest.

Once a crew switches to mechanized logging, they seldom cut trees by hand, less than 10% of the time. Some of the best loggers are still hand-cutting, often at advanced age and working alone or with occasional helpers. I think these older skilled loggers with small-specialized skidders are being hired when the younger inexperienced crews can’t manage a challenging project (too wet, veneer trees, bad access, etc.), but they are less productive. There are not enough younger loggers being recruited in our area, and there are even fewer log truck drivers available, so logs sit on landings for weeks in some cases.

As a forester, I’ve yet to adjust my marking decisions drastically to adapt to mechanized logging. I have, for oak regeneration purposes, started to shift my sales to more small to large group selection and less single tree selection. These types of cuts are obviously better for mechanized logging, although that was not the goal. I still mark every job such that a traditional hand-cutter/skidder crew can cut it, and I don’t plan on changing that. Skidders on the other hand, are now larger by default and I have been marking my main skid trails wider for a few years to compensate. Probably the most important change I need to make is doing a pre-harvest conference with the buyer/logger immediately after the signing of the contract, because I may not make it to the logging job before they are finished.

This was our lowest number of sales in the last 15 years. We discouraged folks from selling timber in 2023, unless it was predominantly White Oak.

If any readers of the Woodland Steward know of anyone from 16 years old to 64 years old who are interested in forest management, I firmly believe most consulting foresters could use part-time help or summer internships. The USDA is telling the consultants that they foresee more acres of work to be funded in Brush Management, Tree Planting, and Forest Stand Improvement in the next couple of years. There is a good chance to see spring wildflowers, morel mushrooms in late spring, deer antlers, nice yellow-poplar, sugar maple, white oak, walnut, and hickory and plenty of invasive weeds to spray.

Landowners who work with foresters and do forest stand improvement and brush management have more high-quality timber, timber growing at a maximum rate, and have a much better chance of oak regeneration for the future. I have a client in that I have had 3 timber sales on and 55-65% of the stand is white oak and it will be ready for another harvest in about 12 years. This tract also has a nice stand of white oak regeneration that is about 15 years old.

Once again white oak and black walnut are still moving very well. The rest is hit or miss but demand has been surprisingly good. The white oak market continues to be driven by the stave market (whiskey barrels). Large white oak especially brings higher values even if they are not high-quality trees.

In southern Indiana large quantities of pine are being sold as there are several different markets available.

Good stuff almost always sells well but it doesn’t mean you should sell it.

Access and contract terms are important to timber value. Financing flexibility and ease of operations can add thousands of dollars to your sale value.

Sealed bid sales on marked and tallied timber offered to a wide range of buyers is the only way to make sure you get the best price for your timber on any given day.

Good or bad timber prices should not be used as an excuse for poor forest management. Planning, waiting for trees to be ready, controlling invasive species and timber stand improvement is still important for the long-term health and productivity of forests and will pay off in the long term.

Professional Consulting Foresters responding to this survey in alphabetical order: Arbor Terra (Mike Warner and Jennifer Boyle Warner), Bear Forestry (Abraham Bear), Cox Forestry Consultants, LLC (David Cox), Creation Conservation, LLC (Brian Gandy), Chris Egloff, Florine Enterprises, LLC (Jake Florine), Gregg Forest Services (Mike Gregg), Habitat Solutions (Dan McGuckin), Haney Forestry, LLC (Stuart Haney), Haubry Forestry Consulting, Inc, (Rob Haubry), Meisberger Forestry, LLC (Matt Meisberger), Multi-Resource Management, Inc. (Doug Brown and Anthony Mercer), Quality Forest Management, Inc. (Justin Herbaugh), Rooted In Forestry, LLC (Mike Denham and Andrew Suseland), Steinkraus Forest Management (Jeff Steinkraus), Turner Forestry, Inc. (Stewart Turner) and Woodland Works (Nate Kachnavage).