2014 Indiana Forest Products Price Report and Trend Analysis

Duane McCoy, Timber Buyer Licensing (LTB) Forester, Jeffrey Settle, Forest Resource Information (FRI), and Chris Gonso, Ecosystem Services Specialist for the Indiana Department of Natural Resources, Division of Forestry and Mike Seidl, Hardwoods Program Manager for the Indiana State Department of Agriculture

Survey Procedures and Response

This report can be used as an indication of price trends for logs of defined species and qualities. It should not be used for the appraisal of logs or standing timber (stumpage). Stumpage price averages are reported by the Indiana Association of Consulting Foresters in the Indiana Woodland Steward, http://www.inwoodlands.org/.

Data is collected once a year, but log prices change constantly. Standard appraisal techniques by those familiar with local market conditions should be used to obtain estimates of current market values for stands of timber or lots of logs. Because of the small number of mills reporting logging costs, “stumpage prices” estimated by deducting the average logging and hauling costs from delivered log prices must be interpreted with extreme caution.

Data for this survey was obtained by a direct mail survey of all known sawmills, veneer mills, concentration yards, loggers and firms producing wood chips, sawdust, etc., as a byproduct. Only firms operating in Indiana were included. The survey was conducted and analyzed by the Indiana Division of Forestry. The prices reported are for logs delivered to the log yards of the reporting mills or concentration yards. Thus, prices reported may include logs shipped in from other states (e.g. black cherry veneer logs from Pennsylvania and New York).

The survey was mailed to 219 firms, compared to 216 in 2013. Several were returned as undeliverable. There was an initial mailing and one reminder postcard sent to non-respondents. Follow-up phone calls and mailing got a few of those mills and operators back into the system.

An abbreviated survey form was used for 87 firms that do not buy logs, compared to 86 in 2013. The long form with the tables for prices paid for sawlogs and veneer logs went to 132 firms, compared to 130 in 2013.

Fifty-four mills reported some useful data, compared to 47 in 2013, 52 in 2012, 56 in 2011, 62 in 2010, 73 in 2009 and 88 in 2008. Seven mills were dropped because their phones were disconnected, or they reported being out of business.

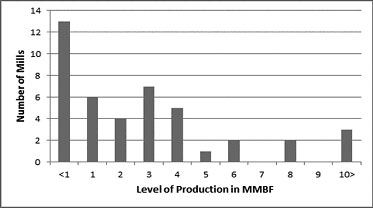

Forty-three mills reported their 2013 board foot production in 2014, compared to 43 reporting their 2012 production in 2013. Thirteen mills reported producing 1 million board feet (MMBF) or less (Figure 1). Eight mills reported production of 5 MMBF or greater. Total production reported for 2013 was 147 MMBF compared to 151 MMBF for 2012, and 134 MMBF for 2011. The largest single mill production reported was 23 MMBF. These annual levels are not comparable since they do not represent a statistical estimate of total production.

The price statistics by species and grade don’t include data from small custom mills, because most do not buy logs, or they pay a set price for all species and grades of pallet-grade logs. They are, however, the primary source of data on the cost of custom sawing and pallet logs.

Hardwood Lumber Prices

Log prices are directly tied to lumber prices since logs are delivered to mills on a continuing basis. This allows mills to base the price they pay for sawlogs on current lumber market prices. The connection to prices paid for standing timber is less direct, depending on how far in advance of logging a stand of timber is purchased.

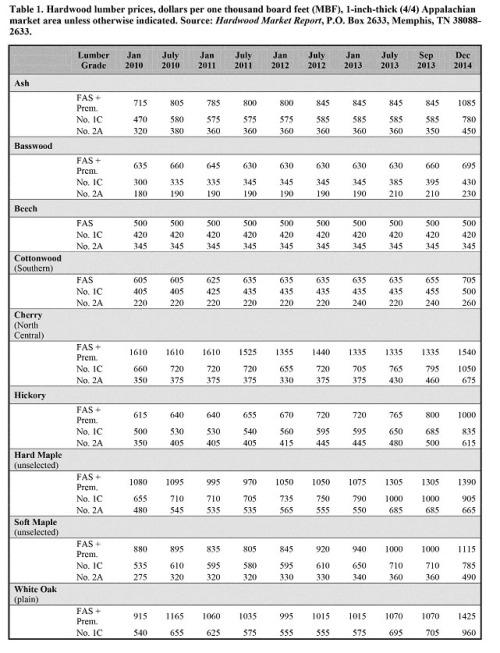

Premium Species

Red oak is an economic indicator species in the hardwood industry. Prices cycle with the general domestic economy and housing. Export markets continue to be a major factor as well. The price of the top grade of lumber, FAS, plus a $200 premium peaked at $1,310 per thousand board feet (MBF) in the summer of 2004 and has been through two cycles since then. It’s been increasing since July 2012, hitting $1,145 per MBF in December 2014 – 27% increase. The premium applies when a buyer negotiates for the purchase of bundles of lumber consisting of No. 1 C and better grades.

White oak price is also cyclical, but the cycles are slightly more moderate than red oak’s. An exception is the 42 percent drop in FAS plus the premium from $1,390 per MBF in 2008 to $800 per MBF in the summer of 2009. In mid-December of 2014, FAS lumber pricing was $1,425 per MBF.

Black walnut is one of the hottest, if not the hottest, species right now. Demand for logs and lumber is very strong. FAS lumber is being reported at $3,040 per MBF, a 37% increase from September 2013.

Black cherry FAS price dropped in January 2013 to $1,335 per MBF. For the most part, however, Black Cherry prices have held pretty steady. Current pricing is $1,540 per MBF.

FAS Hard Maple reached $1,305 in July 2013. Pricing for Hard Maple has picked up slightly in early 2014 but the markets have softened. Current pricing is now around $1,390 per MBF.

Other Species

Yellow poplar hit a low point of $550 in the summer of 2011. Markets have become stronger and demand continues to be good despite increased production. FAS lumber pricing is reported at $830 per MBF, a 34% increase

Soft Maple markets have improved in the past couple of years. In July of 2012, prices were reported at $920 per MBF and current pricing is at $1,115 per MBF.

Locally, Ash markets have become stronger with good volumes of lumber moving overseas as well as being used as a substitute for higher priced Red Oak. December pricing is at $1,085 per MBF, a 22% increase from September 2013.

True to form beech prices were unchanged. FAS last changed in July 2005.

Basswood prices increased to $660 per MBF in September 2013. Current Basswood pricing is at $695 per MBF.

Hickory markets have continued to pick up steam due to the cabinet and rustic flooring markets. Current pricing is reported $1,000 per MBF, a 33% increase since January 2012.

Delivered Sawlog Prices

The number of mills reporting delivered sawlog prices was slightly up this year. Almost without exception sawlog prices of the premium species increased. Sawlog price changes varied for the other species.

Premium Species

All the oak species were up again this year. All four grades of logs increased. Many mills reported paying the same price for both red oak and black oak. It can be difficult to distinguish these two species for logs on a mill’s log deck. The lumber from these two and all other species in the red oak family is sold as simply red oak.

Demand for black walnut has made it difficult for producers to keep up supply, increasing the price for both lumber and sawlogs. However, this year the prices for the lower grade sawlogs increased at a higher rate than that of the prime and grade 1 sawlogs. If the price cycles over the last 10 years are at all predictive, there is room for further price increases.

Black cherry sawlog prices generally increased, with the exception of grade 1 sawlogs, coinciding with increased lumber prices. Prices still remain well below their peak in 2004.

Hard and soft maple are not substitutes in finished goods markets, thus their prices can be expected to behave differently. Hard maple had increases in all grades, but the increases were higher in the lower grade sawlogs. However, soft maple prices increased more in the upper sawlog grades.

The complete 2014 Indiana Forest Products Price Report and Trend Analysis can be read in its entirety at: http://www.in.gov/dnr/forestry/.

Distribution of the 43 mills reporting their 2013 board foot production level in 2014.

Distribution of the 43 mills reporting their 2013 board foot production level in 2014. Table 1. Hardwood lumber prices, dollars per one thousand board feet (MBF), 1-inch-thick (4/4) Appalachian market area unless otherwise indicated. Source: Hardwood Market Report, P.O. Box 2633, Memphis, TN 38088-2633.

Table 1. Hardwood lumber prices, dollars per one thousand board feet (MBF), 1-inch-thick (4/4) Appalachian market area unless otherwise indicated. Source: Hardwood Market Report, P.O. Box 2633, Memphis, TN 38088-2633.